How To Analyze An ETF

In recent years, Exchange Traded Funds (ETFs) have become one of the most popular investment vehicles, particularly for retail investors. This article details how to analyze key characteristics and metrics of an ETF that you need to know before making an investment decision.

#1: ETF Composition

This is the first point for a reason. Your investment returns in an ETF are more contingent on the composition of the ETF than any other factor.

Since ETFs are baskets of securities, like stocks or bonds, the first and most vital question is to ask ourselves, do we know exactly what securities are being held in the fund?

This is what ultimately determines the performance of any ETF you choose to invest your hard-earned money in. If one knows not the composition of the ETF, they know next to nothing about it.

Do not take shortcuts with your research of the assets that make up the ETF. Nothing is more important than knowing what you truly are investing in. Particularly for sector or industry ETFs, one should never invest solely off the general theme that the name of the ETF appears to represent.

For instance, just because a fund is called a broad tech ETF, that doesn’t tell you what are the specific companies that the fund might be holding – Google? Apple? Meta? The same goes for bond ETFs. What are the specific bonds in this case. Who are the issuers? What are the characteristics of these bonds?

These are all vital questions to be asking ourselves when looking to invest in any ETF. After all, when you “invest in an ETF”, you are really just investing in a small slice of every holding within the fund. And if those holdings aren’t what you thought they were, you might be in big trouble.

ETF Weightage

ETF composition is not just about knowing what assets make up the fund, but also how large a percentage they take up of the funds total assets.

Why does this matter? Simply, the larger the weightage that any particular holding occupies within the ETF, the more the performance of that ETF is dependent on the performance of that singular holding, in both good and bad ways.

This brings us to the perennial discussion on diversification. How much weightage should a single holding occupy within the ETF? On one hand, this could mean that if that particular holding performs well, it can carry the performance of the whole ETF. But the effect can work against you in if the reverse of this occurs.

Ultimately, it’s a personal decision on how much weightage you feel comfortable having a single holding or a small group of holdings taking up. A decision made based on your conviction in the individual holdings, your investment objectives, time frame, and risk tolerance.

#2: Expense Ratio

The expense ratio is the fee you have to pay as an investor in an ETF. Fortunately, most ETFs nowadays tend to have relatively low expense ratios.

Expense ratios, though being only small percentages, can be deceptive. This is because when compounded over time, the difference between a 1% expense ratio and a 0.1% expense ratio can be hundreds of thousands of dollars.

For instance, assume two funds have an identical performance of 10% growth over 30 years. Excluding other costs, the fund with a 1% expense ratio effectively gives the investor a 9% return, while the one with the 0.1% expense ratio gives the investor a 9.9% return.

When compounded over time, these seemingly small differences can make a massive difference in the overall growth of your investment sum, and hence must be paid a great attention to.

When it comes to ETFs, passive ETFs that simply aim to replicate the performance of a broad index tend to have very low expense ratios. Popular funds like the Vanguard S&P 500 ETF [VOO] has expense ratios of 0.03% at the time of writing.

More niche ETFs , like sector-specific ETFs tend to have a slightly higher expense ratio, often around 0.3% to 0.6%.

The highest expense ratios tend to belong to actively managed ETFs. The rationale being that you pay a premium because the fund managers are expected to outperform the standard market growth rates (though statistically, most active fund managers aren’t able to do so…)

#3: Benchmark Index

This factor is specific to ETFs that aim to track and replicate the performance of a particular index.

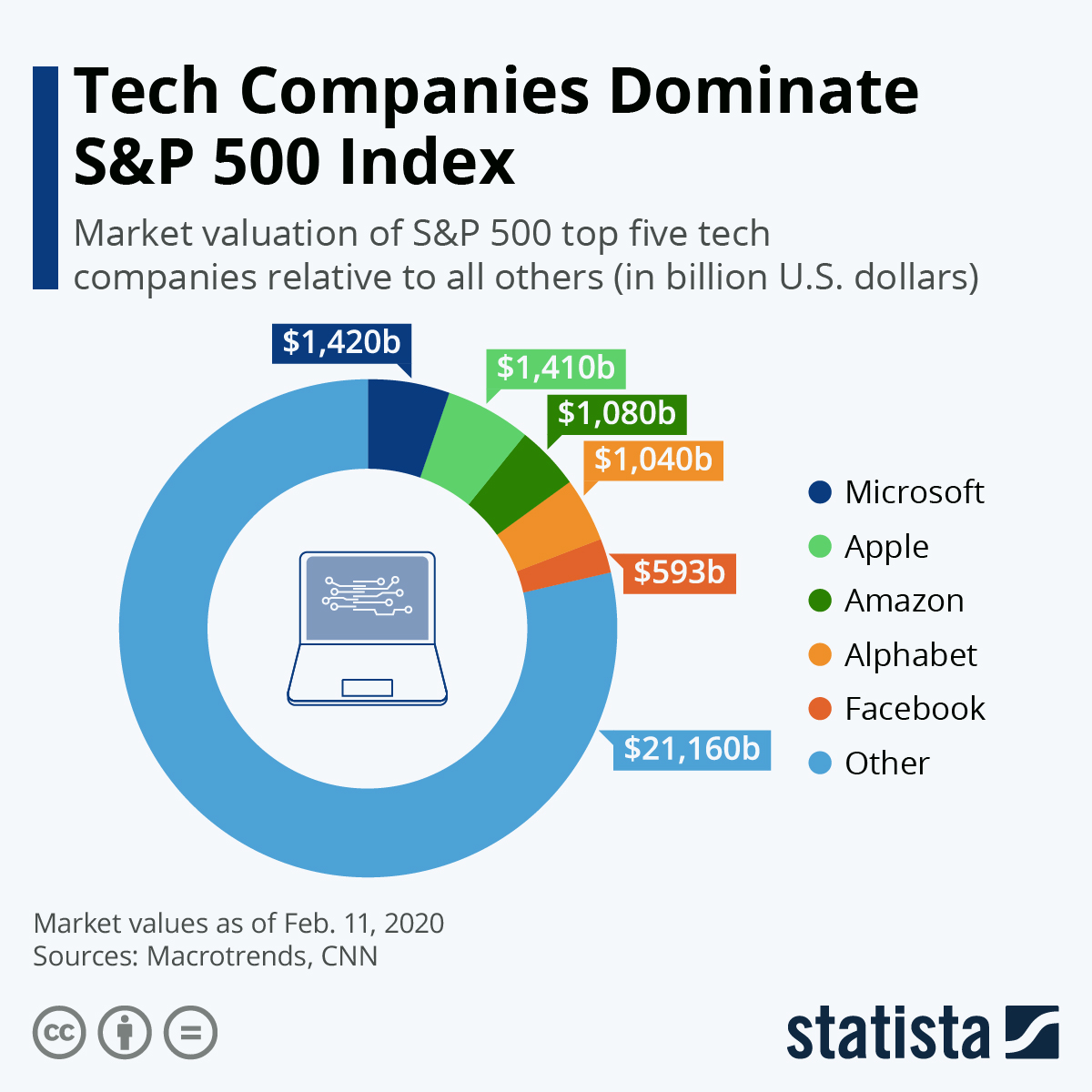

An index serves to measure the collective performance of a group of assets. For instance, the S&P 500 is widely regarded to be the standard index for the American stock market, since it comprises of 500 of the largest listed US companies across various sectors.

But when people say things like: “invest in the S&P 500”, they don’t mean it literally. You can’t invest in the S&P 500 directly, but can only invest in ETFs that seek to replicate the performance of this index. The same goes for any other index.

Knowing what index an ETF tracks is essential, as this would affect the most important factor mentioned earlier – composition. It’s worth researching into the benchmark index itself to understand what criteria an asset needs to meet in order to be included in that index.

#4: Tracking Accuracy

This point is highly related to the benchmark index. For any ETF that seeks to replicate a specific index, there is always going to be some margin of error. As investors, we want the discrepancy in the performance of the benchmark index and the ETF tracking it to be as minimal as possible.

For instance, say the S&P 500 rises by 12% in a given year, but an ETF that has this index as it’s benchmark only rises by 11.5%. This might not seem like much. But when compounded over a period of many years or decades, having a large discrepancy between index performance and actual return can lead to sizeable lost gains.

Much like expense ratios, tracking inaccuracies are a part of ETF investing that eat into your net investment returns. Hence, it is well worth paying attention to.

#5: Turnover

The turnover rate represents how much the fund changes and replaces its holdings over a given time period. Essentially, this represents how much activity is going on behind the scenes with the type and number of holdings in the ETF.

Actively managed funds have a higher turnover than passively managed funds. This is because the fund manager of an active fund makes personal decisions on the composition of the ETF, while a passive fund just has to follow the behavior of the index. Consequentially, a higher turnover rate would likely result in a higher expense ratio.

#6: ETF Overlap

One of the most overlooked aspects of ETF investing is ETF overlap.

What does it mean? Essentially, ETF overlap occurs when you invest in multiple ETFs, but those ETFs have similar holdings between them. For instance, if you invest in the Vanguard S&P 500 ETF [VOO] and the Vanguard Total Stock Market ETF [VTI], you’d have a significant overlap in holdings of large US stocks like Apple, Microsoft, and Amazon.

ETF overlap creates a false sense of diversification.

This is vital to understand: Diversification in ETF investing is not about the number of ETFs you invest in. It is about the differences in the assets held by the ETF.

You could be more diversified with just 2 ETFs, one holding large-cap stocks and the other holding mid-cap stocks, than if you invest in 3 ETFs that were mainly composed of large-cap stocks.

Here’s a useful tool worth bookmarking, to quickly see the ETF overlap between any two ETFs:

Where to find these metrics?

A great way to find all these key metrics in an ETF is by looking at the ETF fact sheet. This is a document that summarizes vital information about the ETF, and is a supremely helpful tool you can utilize when looking into an ETF.