Young vs Mature Companies

The Company Life Cycle

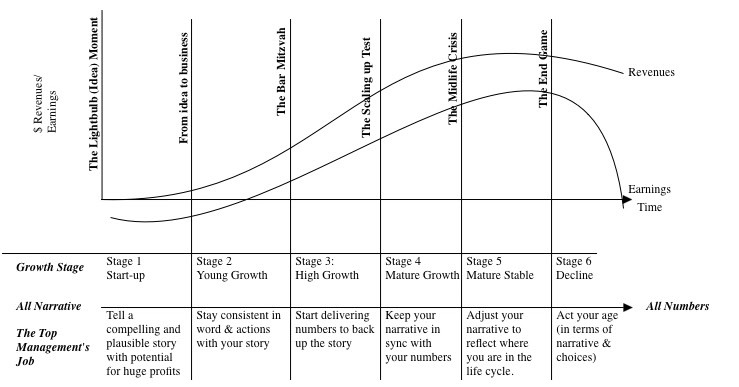

Companies can be in the same industry, sell similar products, and yet still be entirely different in their characteristics.

And one of the reasons why, is that different companies are at different stages of their life cycle.

In particular, this article focuses on how we should expect different things from companies that are in different stages of their life cycle.

And specifically, we will focus on young growth companies vs mature companies.

Area 1: Net Profit Margin

Young companies:

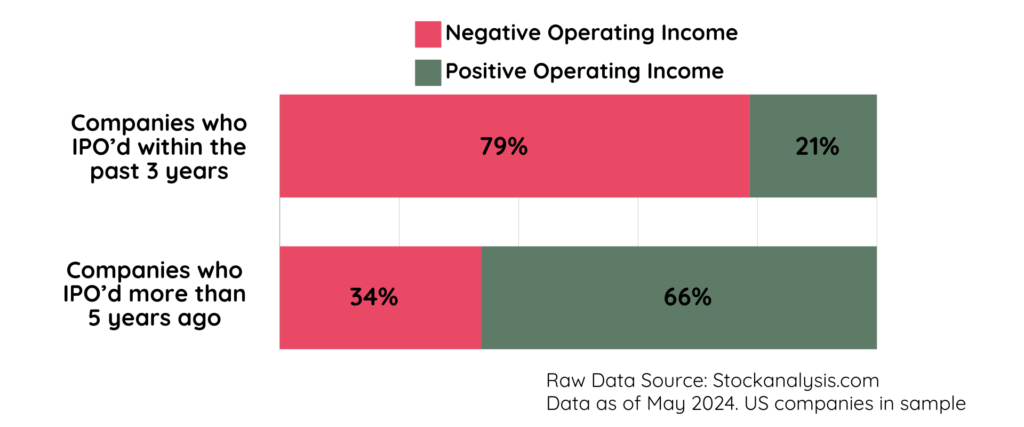

It is not uncommon to observe that many young companies, especially those that have only recently gone public, are often unprofitable.

This is because young companies are often more focused on scaling and reach, instead of maximizing revenues per customer and their production costs.

In fact, using stockanalysis.com’s premium screening tool, I tabulated the data below, which shows that most US companies who IPO’d within the past 3 years ago actually have negative operating income (let alone net income).

In traditional investing, it is often regarded as a ‘red flag’ if a company is unprofitable.

But within the context of young and rapidly scaling companies, this may not be as much of a cause of concern. For them, what matters more is when we might expect them to turn profitable.

Mature companies:

On the other hand, it would often be highly concerning if a mature company was NOT profitable.

Generally, for mature companies, assuming that they are already profitable, our main concern should be on its ability to maintain (or possibly even grow) its profit margins.

Because as new competitors arrive in the market and try to steal market share, this could significantly hurt our company’s profit margins.

This is why investors often aim to find companies with strong competitive advantages (a.k.a moats), that enable them to maintain a dominant position in the market and fend off competitors.

Metric To Measure

Net profit margin = (Net income ÷ Revenue) × 100%

Area 2: Debt

Young companies:

Typically, young companies should not be taking on much debt funding, and there is a clear reason why: They do not have the financial ability to pay it back.

As established, many young companies already have a negative operating income, and added interest expense can be very dangerous to be obligated to.

This is why young companies are far more inclined to pursue equity funding, through issuing out new shares to investors. Of course, this comes with the downside of diluting the value of each share.

Mature companies:

On the other hand, a mature company, with stable and consistent cash flows, should indeed take advantage of debt funding, since it has the ability to reliably pay it back.

In this case, our main concern as investors would shift to: “What is the interest rate on the debt?”.

If a company is able to get cheap debt funding at a low interest rate, it able to access capital at a relatively low cost, to pursue further investments into growing the company, acquisitions, etc.

Generally, for mature companies, assuming that they are already profitable, our main concern should be on its ability to maintain (or possibly even grow) its profit margins.

Metric To Measure

Debt to equity (D/E) ratio = Total Debt ÷ Total Equity

The higher the D/E ratio, the more debt funding the company is relying on.

Area 3: Reinvestment

Young companies:

We want young companies to be reinvesting as much of their profits (if any) back into the business as possible.

The reason is simple. When it comes to reinvestment vs returning profits to shareholders, the question is “which option yields a better return?”.

Well, if the company still has a lot of room to grow, which young companies typically do, then it should indeed be cycling its profits back into scaling its own operations.

Mature companies:

With mature companies, it’s slightly trickier. Of course, it still needs to reinvest enough to keep everything up and running.

But at some point, the company may find that it has excess profits which could be better used if it was just returned to shareholders.

This is why investors tend to expect mature companies to pay out dividends or have share repurchase programs.

Metric To Measure

Retention ratio = 1 – (Dividends ÷ Net profit)

The higher the retention ratio, the less that the company is returning/paying out to shareholders.

We would expect a young company to have a higher retention ratio.