The Core-Satellite Approach

What is the Core Satellite Method?

The Core Satellite approach is one of many methods that investors use to build their investment portfolio. It is a popular portfolio allocation approach that aims to strike a good balance between risk-management and returns.

Why is it called the Core-Satellite strategy?

The ‘Core’, or bulk of the portfolio, is centered around low-to-medium risk investments while the ‘Satellites’ refer to small portions of the portfolio focused on higher risk investments for growth.

This content is not investment advice. It is made purely for informational purposes only.

The Core

Making up the majority of one’s investments, the core’s main function is for wealth preservation and steady appreciation. Since most of the value of the portfolio is stored in the core, the core comprises of less volatile and risky investments.

Naturally, everyone has different investment goals and levels of risk tolerance. As such core investments can vary significantly in their level of risk and returns. For the sake of example, let’s look at two types of core portfolio styles – a growth-oriented core and a defensive core.

Growth-Oriented Core

Focus: Steady appreciation, with an acceptance of some volatility

Common picks

- Index funds & ETFs

- Dividend stocks

- Blue chip stocks

- Real Estate

Defensive Core

Focus: Wealth preservation

Common picks

- Bonds

- Defensive Stocks

- Cash Equivalents

Importance of the Core

Risk management is a vital aspect of investing. A stable core is vital to ensuring that the portfolio does not get wiped out during events such as market downturns.

A well-balanced designed core allows one to combat inflation’s effects and generate steady returns.

In the Core Satellite approach, there’s no need to make an excessively growth-oriented core, as that role is fulfilled by the satellites. Instead, core growth aims to be stable and consistent. Including too many risky investments into the core can leave one vulnerable to losing significant portfolio size during market downturns.

Satellites

What are the satellites?

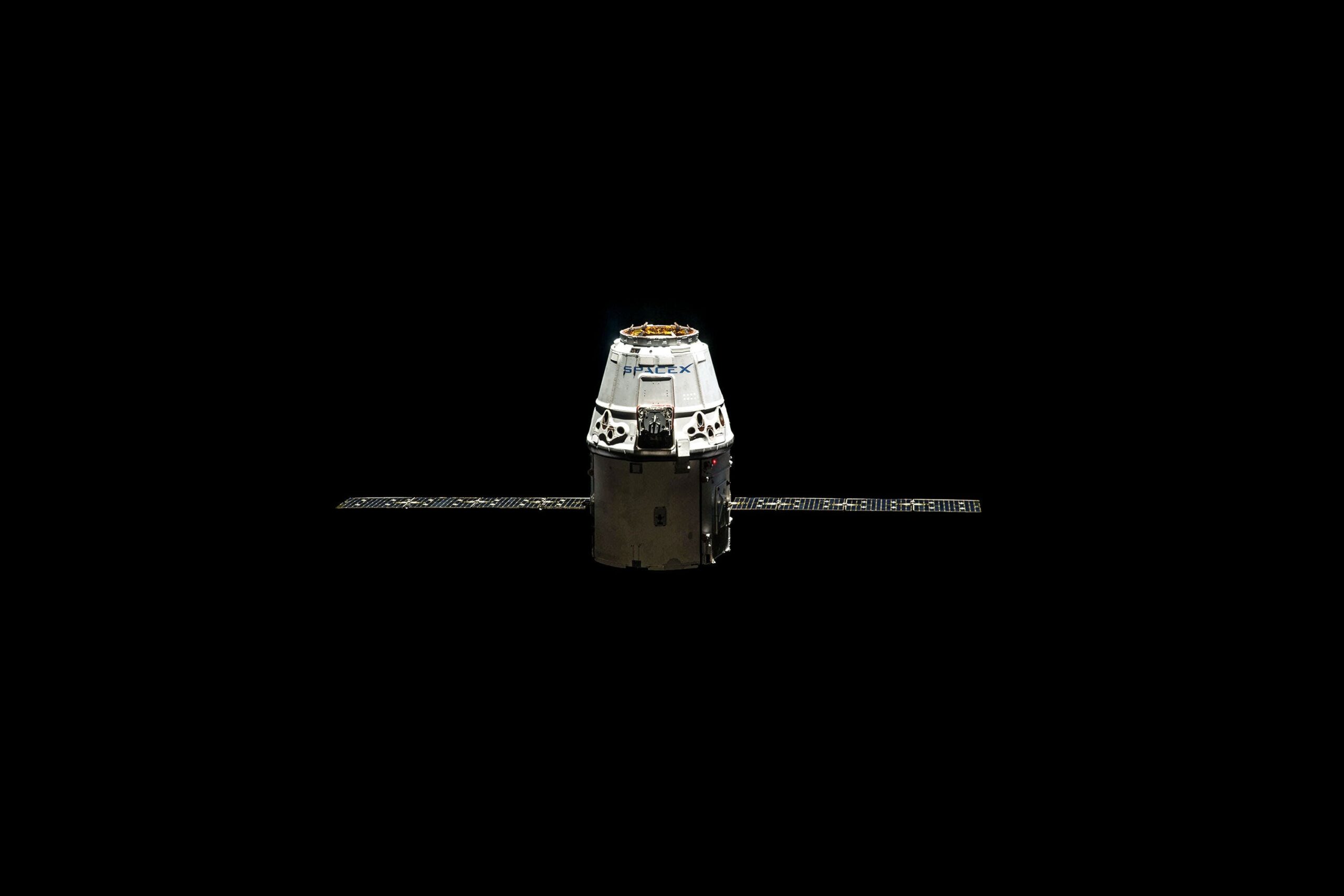

The name ‘satellites’ comes from the fact that relative to the core, they are smaller, riskier investments. And just like launching satellites into orbit in real life, satellite investments have a high risk, but also potential for higher returns.

Characteristics of satellite investing

- There is always more than one satellite

- Each satellite takes up only a tiny portion of the portfolio

- Aims to capture growth while accepting risk and volatility

Satellite Investments

Satellite investments often hold higher risk and price volatility, but also have the potential for larger returns on investment.

Some examples include:

- Picking individual stocks, especially growth-oriented ones

- Niche ETFs

- Investing in emerging markets

- Commodities

Risk management

Launching a real-life satellite into orbit without running comprehensive calculations and extensive research is crazy. Yet people often do that with investing too.

In both cases, not doing one’s own due diligence is a huge waste of money that crashes and burns.

How good is the core-satellite approach?

No investing strategy is perfect. Let’s analyze the benefits and drawbacks of such an investing approach.

Arguments in favour

Balance is the premier feature of this investing strategy. If you’re not looking for either aggressive growth or defensive wealth protection, it could be the most suitable approach for you.

Additionally, many consider the Core-satellite method to be a beginner-friendly strategy. With the protection from the core, it gives newbies the safety to try their hand at riskier investments without getting burnt too severely should they fail.

Arguments against

Being a generalist approach, the Core Satellite approach can never give you either the assured wealth protection of a purely defensive portfolio, or the potential for massive returns that a growth-prioritized portfolio offers.

Another drawback is one arising from investor psychology. Because satellites innately take up a relatively small percentage of the portfolio, this might incentivise investors to take blind risks, viewing these satellites as “throwaway investments”. This is an unfortunately common problem in the investing community.