Survivorship Bias In Investing

What is survivorship bias?

Survivorship bias is a common cognitive bias that arises from our tendency to focus on ‘success stories’ (survivors), and neglecting the ‘failures’, leading to a skewed perspective of reality.

In blunt terms, survivorship bias is our tendency to shine the spotlight on winners/survivors, and think that their outcomes are the norm.

Survivorship bias in action

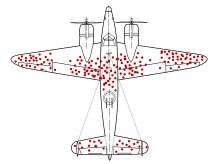

During World War II, the American military sought out to reinforce their planes to increase their durability in aerial combat.

By studying the patterns of bullet holes on damaged planes that returned to base, it seemed that the clear conclusion was to reinforce the areas that had clearly been perforated by bullets.

However, statistician Abraham Wald pointed out that this analysis had only considered the planes that albeit damaged, had returned to base, but not the ones that had been shot down.

Thus, it would in fact be wiser to reinforce the parts of the returning planes that were not hit. After all, the parts that were perforated were clearly not causing catastrophic damage to the plane.

Clearly, the fact that the data provided only included the surviving planes ended up giving most people the wrong impression of the true nature of the plane’s critical parts. That’s how survivorship bias works. And it’s mighty prevalent in the world of finance too.

The illusion of easy gains

History is written by the victors. And when it comes to investing, the victors are often all we see.

You see this in the stock market community all the time. Whether it’s a fund manager, public figure, or content creator, achieving outsized investments gains receives hefty media coverage and views. Meanwhile, another person who took a similar approach, with a similar level of risk, might’ve lost money.

And when it comes to stock picking, it is statistically more often than not, the case that most investors either lose money or fail to beat the standard index returns.

Certainly, the average Joe who invests in a ‘boring’ index fund and gets standard market returns doesn’t get the same media coverage. This, despite the fact that they are making the choice that statistically is far more likely to work over the long run.

Survivorship bias creates the illusion that achieving giant investment returns are not that rare, nor as difficult to achieve than they really are. It paints the idea that, maybe you too could have that ‘Midas Touch’ to make huge investment gains. And it’s a psychological trap that many beginners fall for, exacerbated by the Dunning-Kruger Effect.

This isn’t to say that achieving above-standard investment returns is impossible. But it’s certainly not as easy as many make it out to be. The fact that we only shine the light on the “winners” makes it seem like those achievements are far more easily achievable than they really are.

Consequences of survivorship bias

By my observation, survivorship bias in stock market investing has led to the following primary outcomes:

- Taking large, uninformed risks in search of massive returns

- Overconfidence in one’s own abilities

- Ignoring statistical data.

These effects are most exacerbated in niche communities, like the infamous WallStreetBets community on reddit. When achieving overnight fortunes and ‘going all-in-or-nothing’ is glorified, the financial consequences of a single bad decision can be devastating.

In a less extreme sense, this can be extended to the observation that many complete beginner investors, tend to opt towards picking individual stocks instead of broad market indexes. Especially given the fact that most of them might not ever have heard of concepts like valuation, or ever glanced at a financial statement.

Of course, the Dunning-Kruger Effect plays a significant role here too. But survivorship bias is what entices them in the first place. The glorification of outsized investment returns is what sparks the urge to chase larger gains from the get go, despite having little knowledge.