6 Types Of Stocks

6 Types Of Stocks

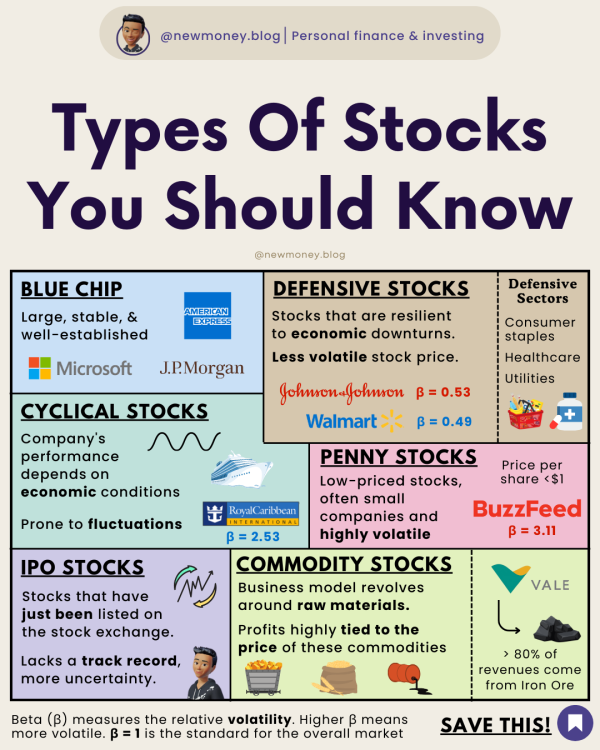

#1: Blue Chip Stocks

A blue-chip stock refers to the stock of a company that has the following characteristics:

- Large in size

- Dominant player in its market

- Stable with strong and sustainable future prospects

These would usually be well-known names, like Apple, Microsoft, JP Morgan, etc.

Many investors gravitate towards blue-chip stocks, based on the belief that they provide an optimal mix of potential growth and predictable results.

And while this does often hold true, it is important to never get complacent. For instance, IBM (International Business Machines) was the largest US stock by market cap in the 80s, making it the bluest of blue chips.

Yet, today, while the company is still large, IBM is no longer the world-shaker it used to be regarded as. At the time of writing (May 2024), it is the 52nd largest US company.

#2: Cyclical Stocks

A cyclical company is a company whose financial performance is highly dependent on the prevailing economic conditions.

The most intuitive example is the hospitality and tourism industry. When the economy is doing well and incomes are rising, consumers spend more on leisure and travel. A company in the tourism industry, (e.g., Royal Caribbean which operates cruises) would experience greater revenues during these periods.

Conversely, during an economic downturn, consumers cut back on leisure and travel. A company in this industry would experience a fall in revenues during these periods.

These fluctuations in the company’s underlying financial performance, profits and cash flows, ultimately translate into the stock’s price. The stock price goes through periods of large growth and large declines over time. As opposed to growing steadily.

#3: Defensive Stocks

On the opposite end of the spectrum to a cyclical stock is a defensive stock.

A defensive stock refers to the stock of a company whose financial performance is resilient to varying economic conditions.

(a.k.a The company performs consistently regardless of the broader economic situation.)

These companies sell products that are necessities. Products that people will always have to be buying, all the time. (E.g., groceries, healthcare).

These companies sell products that are necessities. Products that people will always have to be buying, all the time. (E.g., groceries, healthcare).

Even if the economy is going through a recession, people will still be buying these products.

This means that the company’s revenues remain consistent over time. And this stability in financial performance of course translates into their stock prices too.

Defensive stocks tend to have lower beta values (β). With beta representing how a stock’s price moves relative to the overall market.

For instance, at the time of writing, Walmart’s beta β is 0.49.

This means that when the market goes up or down by 1%, Walmart’s stock tends to only go up or down by 0.49%.

#4: Penny Stocks

The name “penny stocks” comes from the fact that some stocks have share prices in the range of pennies ($0.01).

But this term more generally refers to stocks whose price per share is under $1.

These companies are characterised by typically having:

- Small market capitalizations

- High volatility

- Low liquidity

It is often said that investors should stay away from penny stocks due to their uncertainty and volatility.

Others might argue that there is more opportunity in these “undesirable” stocks. Ultimately, it is an individual decision that requires a careful analysis of the potential risks.

#5: IPO Stocks

“IPO stocks” refer specifically to companies that have recently been listed on a stock exchange.

IPO stands for “Initial Public Offering”. It is the process by which a company gets listed on a stock exchange, where its shares become available to the public.

If we look at some of the biggest stocks in the world today, like Microsoft, Nvidia, Amazon, etc. it is easy to use hindsight and say:

“If only I had invested in these when they had just IPO’d, I’d have made a fortune.”

But the reality is when a company has just become listed, it lacks a track record and is rife with uncertainty.

For every Microsoft and Nvidia, there are countless other stocks that IPO’d that fell flat shortly after.

Due to the massive uncertainty associated with recent IPO companies, many investors tend to avoid IPO stocks. Though there is potential for incredible upside, there are also countless unknowns associated with a company that has only just gone public.

#5: Commodity Stocks

A commodity stock is the stock of a company that derives most of its revenues from sale of raw materials (commodities).

These raw materials in question could be anything from precious metals (e.g., gold) to agricultural products (e.g., wheat).

For instance, the Brazillian company Vale is currently the largest South American company by market cap. Vale currently derives over 80% of its revenues from its iron ore business.

Since its revenues come from the sales of commodities, a commodity company’s financial performance is highly dependent on the price of that commodity.

This content is not investment advice. It is made purely for informational purposes only.